Table of Content

Today, their interests cover a diverse range of fields, including financial services, real estate, mining, energy, agriculture, winemaking, and nonprofits. Many examples of the family's rural architecture exist across northwestern Europe. The Rothschild family has frequently been the subject of conspiracy theories, many of which have antisemitic origins. Since 2003, a group of Rothschild banks have been controlled by Rothschild Continuation Holdings, a Swiss-registered holding company (under the chairmanship of Baron David René de Rothschild). Rothschild Continuation Holdings is in turn controlled by Concordia BV, a Dutch-registered master holding company.

Amartya Sen , Nobel Laureate, Indian economist and philosopher, married Emma Georgina Rothschild of the Rothschild banking family of England. In Vienna, Salomon Mayer Rothschild established a bank in the 1820s and the Austrian family had vast wealth and position. The crash of 1929 brought problems, and Baron Louis von Rothschild attempted to shore up the Creditanstalt, Austria's largest bank, to prevent its collapse.

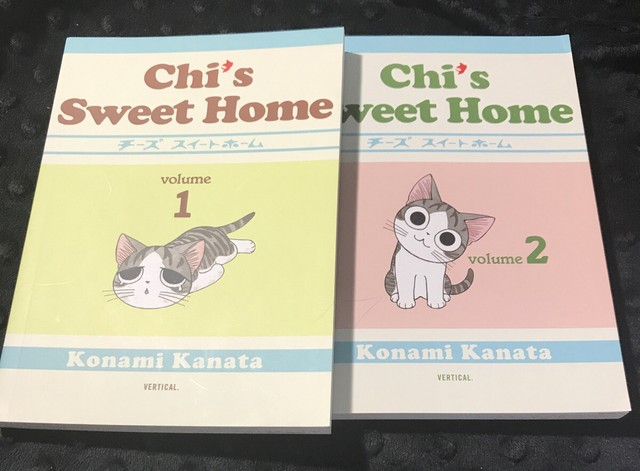

Shelve The Complete Chi's Sweet Home, Part 4

Another Nazi film, Die Rothschilds , was directed by Erich Waschneck in 1940. A Broadway musical entitled The Rothschilds, covering the history of the family up to 1818, was nominated for a Tony Award in 1971. Nathaniel Mayer ("Natty") Rothschild, 1st Baron Rothschild appears as a minor character in the historical-mystery novel Stone's Fall, by Iain Pears.

James Mayer de Rothschild's other son, Edmond James de Rothschild (1845–1934), was very much engaged in philanthropy and the arts, and he was a leading proponent of Zionism. His grandson, Baron Edmond Adolphe de Rothschild, founded in 1953 the LCF Rothschild Group, a private bank. Since 1997, Baron Benjamin de Rothschild chairs the group. The group has €100bn of assets in 2008 and owns many wine properties in France (Château Clarke, Château des Laurets), in Australia or in South Africa. In 1961, the 35-year-old Edmond Adolphe de Rothschild purchased the company Club Med, after he had visited a resort and enjoyed his stay.

Other books in the series

They take the kitten home, but, as pets are not allowed in their housing complex, they try to find her a new home. This proves to be difficult, and the family decides to keep the kitten. Is a Japanese manga series written and illustrated by Kanata Konami.

Nathan Mayer's eldest son, Lionel de Rothschild (1808–1879), succeeded him as head of the London branch. Under Lionel, the bank financed the British government's 1875 purchase of Egypt's interest in the Suez Canal. The Rothschild bank also funded Cecil Rhodes in the development of the British South Africa Company.

Shelve Chi's Sweet Home, Volume 12

In 2003, following Sir Evelyn's retirement as head of N. M. Rothschild & Sons of London, the British and French financial firms merged under the leadership of David René de Rothschild. Nothing is more heartbreaking to a mother than losing a child. There is nothing that can replace family, and when one is lost at such a tender age it is even more distressing as uncertainty over the child’s survival weighs heavily. As Chi Yamada has shown, kittens are a resourceful and strong lot. Through play and exploration they learn to hunt for their food and to define their territory, much like the big cats of the savannah and jungle.

Saskia de Rothschild was named Chairwoman of Château Lafite Rothschild in 2018, succeeding her father, Éric de Rothschild. Château Mouton Rothschild was managed by Philippine de Rothschild until her death in 2014. It is now under the direction of her son Philippe Sereys de Rothschild. In December 2009, Jacob Rothschild, 4th Baron Rothschild invested $200 million of his own money in a North Sea oil company. In 2001, the Rothschild mansion located at 18 Kensington Palace Gardens, London, was on sale for £85 million, at that time the most expensive residential property ever to go on sale in the world.

It was built in marble, at 9,000 sq ft, with underground parking for 20 cars. N M Rothschild & Sons, an English investment bank, does most of its business as an advisor for mergers and acquisitions. In 2004, the investment bank withdrew from the gold market, a commodity the Rothschild bankers had traded in for two centuries. In 2006, it ranked second in UK M&A with deals totalling $104.9 billion. In 2006, the bank recorded a pre-tax annual profit of £83.2 million with assets of £5.5 billion. Many Rothschilds were supporters of Zionism, while other members of the family opposed the creation of the Jewish state.

Edmond de Rothschild Group's committee is currently being chaired by Benjamin de Rothschild, Baron Edmond's son. The C M de Rothschild & Figli bank arranged substantial loans to the Papal States and to various Kings of Naples plus the Duchy of Parma and the Grand Duchy of Tuscany. However, in the 1830s, Naples followed Spain with a gradual shift away from conventional bond issues that began to affect the bank's growth and profitability. However, in the early 19th century, the Rothschild family of Naples built up close relations with the Holy See, and the association between the family and the Vatican continued into the 20th century. The 1906 Jewish Encyclopedia described the Rothschilds as "the guardians of the papal treasure".

In addition to being extremely cute, this was surprisingly accurate! Recommend to anyone who has experienced or would like to vicariously experience the first months of living with a cat. I loved it, it got me out of my reading slump and I'm just so excited to dive back in to reading. This new location will bring with it new faces, new... Japan's latest kitty phenomenon is rising up the U.S. charts and has quickly become a publishing sensation. Presented in full-color and left-to-right format, Chi and her collection of furry and feathery friends are backwith more ad...

The British Chancellor of the Exchequer David Lloyd George claimed, in 1909, that Nathan, Lord Rothschild was the most powerful man in Britain. The Rothschild family was directly involved in the independence of Brazil from Portugal in the early 19th century. Upon an agreement, the Brazilian government should pay a compensation of two million pounds sterling to the Kingdom of Portugal to accept Brazil's independence. N M Rothschild & Sons was pre-eminent in raising this capital for the government of the newly formed Empire of Brazil on the London market. In 1825, Nathan Rothschild raised £2,000,000, and indeed was probably discreetly involved in the earlier tranche of this loan which raised £1,000,000 in 1824. Part of the price of Portuguese recognition of Brazilian independence, secured in 1825, was that Brazil should take over repayment of the principal and interest on a £1,500,000 loan made to the Portuguese government in 1823 by N M Rothschild & Sons.

No comments:

Post a Comment